This coming Wednesday morning, Utah based multi-level marketing company Nu Skin Enterprises (NYSE: NUS) is scheduled to report its second quarter earnings. In its Q1 2014 10-Q report issued in May, major questions were left unanswered as inventories ballooned to $410 million. This pile of inventory is equal to enough merchandise to fulfill 346 days of sales – compared to only 149 days of sales in the comparable first quarter of the previous fiscal year. It's an increase of 132% over the prior year – an enormous red flag that shareholders would have expected management to explain in significant detail.

Rising inventory levels don't square with management's explanation

In its Q1 2014 10-Q report (page 17), Nu Skin claimed that, "we built a large amount of inventory during the first quarter for planned product launches in 2014...." However, Nu Skin’s excuse does not square with its own reported numbers. In reality, the inventory buildup had been going on for some time.

Since 2011, there is a clear and growing trend of inventory pileup – even as management consistently beats its most optimistic revenue guidance. See the chart below:

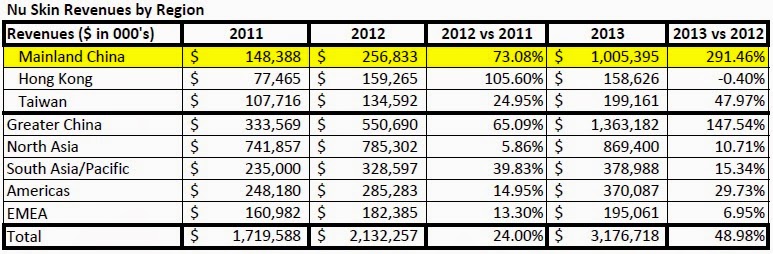

In the second half of 2013, Nu Skin introduced its ageLOC TR90 weight management system through limited-time offerings in each of its regions. Those sales were carefully choreographed with local management to maximize short term purchases of ageLOC TR90 under the rubric of a limited-time offer (LTO). On the surface, the new product introductions appeared to be highly successful. Revenues during the second half of 2013 rose 78.7% to $1.96 billion compared to $1.099 billion in the second half of 2012 fueled most by growth in Mainland China. In the 2013 10-K report (page 55), management had this to say about ageLOC TR90’s contribution to revenues:

In the second half of 2013, the successful limited-time offers of ageLOC TR90 generated approximately $550 million in revenue with over half of this volume coming from the Greater China region.

However, despite a huge growth in revenues and beating its most optimistic revenue guidance during that period, the amount of time it took Nu Skin to sell its inventory increased 30.2% to 190 days as of 12/31/13 compared to 146 days on 6/30/13, at the start of its launch of ageLOC TR90. This trend took a major ramp in the first quarter of 2014, where for the first time in the company’s history its warehouses are holding enough merchandise to cover practically the next 12 months of sales (346 days). Despite management’s claim that inventory ballooned because of planned product launches, Wall Street analysts seem unimpressed as their most recent consensus estimates call for year-over-year revenue declines during the remainder of 2014.

Inventory purchase obligations compound problem

Companies the size of Nu Skin can’t exactly turn off the manufacturing lines for six months while they whittle down inventory to normalized levels. According to its most recent 10-K report (page 2), Nu Skin utilizes a number of 3rd party contract manufacturers, mainly located in the US (except for China, where the company does its own manufacturing).

Nu Skin must work closely with its raw material suppliers and US contract manufacturers to plan ahead for inventory production as factories of this size cannot be turned on or off on a dime. As disclosed in the 2013 10-K (page 65), at year-end Nu Skin had $155.9 million of minimum outstanding purchase obligations as compared to 2013’s company-wide cost of goods sold of $505.8 million. Curiously, this figure like many important inventory-related metrics is deliberately not disclosed on a quarterly basis.

What has gone largely unnoticed is that in December 2012 the amount of purchase obligations was $32.1 million as compared to 2012's company-wide cost of goods sold of $353.2 million (See 2012 10-K report, page 59). This is a five-fold jump between 2012 and 2013 – yet overall cost of goods sold grew only 43% year-over-year. There is only one geographic location whose revenue grew at more than 100%+ year-over-year and could be responsible for this massive growth in future obligations – China.

What is the composition of Nu Skin's inventory and where is it located?

Nowhere in the 2014 Q1 10-Q report or in the accompanying management call with shareholders on May 6th did the company disclose (a) where the bulk of its inventory is located, and (b) what products comprise the majority of its inventory. These two questions are perhaps the single most important metrics that management needs to disclose on Wednesday in order to determine whether or not Nu Skin is heading for a potentially crippling write-down of inventory. As we noted above, the massive buildup in inventory cannot solely be attributed to planned product launches during the remainder of 2014.

Why is the makeup of the inventory so crucial? This is because a truthful answer to the question would shed light on the biggest question mark hanging over management’s performance to date: Is the massive buildup of inventory in any way related to global missteps with ageLOC TR90 rollouts?

Last year’s global launch of ageLOC TR90 was met with mixed results. For example, during the last two quarters of 2013, 35.6 % Greater China revenue came from limited-time offer (LTO) sales of TR90 compared to only 17.26% for Japan. Are the excess inventories TR90 supplies in China or are they being stored in Japan or some other location with tepid demand?

See the chart below:

Nowhere in the 2014 Q1 10-Q report or in the accompanying management call with shareholders on May 6th did the company disclose (a) where the bulk of its inventory is located, and (b) what products comprise the majority of its inventory. These two questions are perhaps the single most important metrics that management needs to disclose on Wednesday in order to determine whether or not Nu Skin is heading for a potentially crippling write-down of inventory. As we noted above, the massive buildup in inventory cannot solely be attributed to planned product launches during the remainder of 2014.

Why is the makeup of the inventory so crucial? This is because a truthful answer to the question would shed light on the biggest question mark hanging over management’s performance to date: Is the massive buildup of inventory in any way related to global missteps with ageLOC TR90 rollouts?

Last year’s global launch of ageLOC TR90 was met with mixed results. For example, during the last two quarters of 2013, 35.6 % Greater China revenue came from limited-time offer (LTO) sales of TR90 compared to only 17.26% for Japan. Are the excess inventories TR90 supplies in China or are they being stored in Japan or some other location with tepid demand?

See the chart below:

Note: In Q4 2013, Nu Skin reduced its revenues going back at least three years to correct an accounting error in classifying certain rebates (2013 10-K report, page 50). The error caused relatively minor changes in previously reported revenues for the first three quarters of 2013. While the company revised its quarterly revenues on a consolidated basis (page 68), it did not revise its quarterly revenues by region. To calculate revenues by region for the last six months of 2013, we subtracted six month revenues from full year revenues for each region. There may be slight discrepancies in revenues numbers for each region during that period. Nu Skin did not report LTO revenues for the individual Americas and EMEA regions. The combined LTO revenues for both regions were computed by subtracting LTO revenues disclosed for other regions from total LTO revenues.

In the Q1 2014 10-Q report (page 13), management hinted at problems with its limited-time offer ageLOC TR90 product launch:

Management is on record as stating that the customers of ageLOC TR90 were sold on 90 day supplies of product:

Did first time customers use the product for 90 days and then decline to reorder? Is the Chinese subsidiary or some other subsidiary sitting on piles of TR90 refills that are languishing unsold?

With the large cut in active salespeople operating in China ( “Sales Leaders”, Nu Skin’s term for individuals engaged in hawking goods for resale to others, dropped 49% in the quarter due to various regulatory concerns) if global inventory is heavily weighted towards that region, then the oversupply isn’t going to get whittled down anytime soon.

Clearly the 346 day supply of global inventory is sitting somewhere, made up of something. If a large proportion of it is TR90 goods located in geographies where the reorder levels are poor, it is inevitable that Nu Skin shareholders are staring at an imminent inventory write-down. Management doesn’t provide enough quarterly disclosure to support its claims that their “optimism for China remains intact” (transcript, May 6th, 2014 earnings call). If management truly wishes for its shareholders to share such optimism it should start by giving a detailed breakdown on inventory both inside and outside China.

What management must do

It’s very simple: if Nu Skin has hit the wall in getting customers hooked on buying overpriced weight loss pills direct from your neighbor, then the first place you would see the flashing reds lights warning of trouble ahead would be in the inventory buildup. We have shown how it is extremely likely – given the growth in future purchasing obligations – that the inventory buildup is most likely affecting China the most. Providing shareholders with a detailed breakdown of where the inventory is located and what it’s comprised of is the only way these nagging issues can be laid to rest.

Written by,

Sam E. Antar and Zachary Prensky

Disclosure - Sam E. Antar

Sam E. Antar is a convicted felon and a former CPA. As the criminal CFO of Crazy Eddie, Mr. Antar helped mastermind one of the largest securities frauds uncovered during the 1980s. Today, he advises federal and state law enforcement agencies about white-collar crime and trains them to identify and catch white-collar criminals. Mr. Antar refers cases to them as an independent whistleblower. He teaches about white-collar crime for government entities, businesses, professional organizations, and colleges and universities. In addition, he performs forensic accounting services for law firms and other clients. Sam E. Antar does not own any Nu Skin securities long or short and has no financial relationship with Zachary Prensky.

Disclosure - Zachary Prensky

At the time of the publication of this report, Zachary Prensky and/or affiliates hold short positions in Nu Skin common stock. More of Mr. Prensky's research can be found at the website of his firm, Little Bear Investments LLC.

In the Q1 2014 10-Q report (page 13), management hinted at problems with its limited-time offer ageLOC TR90 product launch:

We believe the significant 2013 sales and the three-month supply kit configuration decreased consumer demand in subsequent regional limited-time offers of this product during the first quarter. In addition, TR90 was developed to decrease fat without sacrificing lean muscle. The result is a healthier body composition but not necessarily maximum weight loss. Our research shows that some consumers of TR90 were dissatisfied with the extent of their weight loss. [Emphasis added.]

Management is on record as stating that the customers of ageLOC TR90 were sold on 90 day supplies of product:

TR90 so far has only been sold in LTOs in a three month supply. We believe that consumers will benefit from being able to try the product first before making a three-month commitment. In addition, we have also realized that with weight management probably more than with any other category, it is tough to take a product off the market post LTO. Consumers in weight management just don't enjoy a start again/stop again reality. [Emphasis added.]

Did first time customers use the product for 90 days and then decline to reorder? Is the Chinese subsidiary or some other subsidiary sitting on piles of TR90 refills that are languishing unsold?

With the large cut in active salespeople operating in China ( “Sales Leaders”, Nu Skin’s term for individuals engaged in hawking goods for resale to others, dropped 49% in the quarter due to various regulatory concerns) if global inventory is heavily weighted towards that region, then the oversupply isn’t going to get whittled down anytime soon.

Clearly the 346 day supply of global inventory is sitting somewhere, made up of something. If a large proportion of it is TR90 goods located in geographies where the reorder levels are poor, it is inevitable that Nu Skin shareholders are staring at an imminent inventory write-down. Management doesn’t provide enough quarterly disclosure to support its claims that their “optimism for China remains intact” (transcript, May 6th, 2014 earnings call). If management truly wishes for its shareholders to share such optimism it should start by giving a detailed breakdown on inventory both inside and outside China.

What management must do

It’s very simple: if Nu Skin has hit the wall in getting customers hooked on buying overpriced weight loss pills direct from your neighbor, then the first place you would see the flashing reds lights warning of trouble ahead would be in the inventory buildup. We have shown how it is extremely likely – given the growth in future purchasing obligations – that the inventory buildup is most likely affecting China the most. Providing shareholders with a detailed breakdown of where the inventory is located and what it’s comprised of is the only way these nagging issues can be laid to rest.

Sam E. Antar and Zachary Prensky

Disclosure - Sam E. Antar

Sam E. Antar is a convicted felon and a former CPA. As the criminal CFO of Crazy Eddie, Mr. Antar helped mastermind one of the largest securities frauds uncovered during the 1980s. Today, he advises federal and state law enforcement agencies about white-collar crime and trains them to identify and catch white-collar criminals. Mr. Antar refers cases to them as an independent whistleblower. He teaches about white-collar crime for government entities, businesses, professional organizations, and colleges and universities. In addition, he performs forensic accounting services for law firms and other clients. Sam E. Antar does not own any Nu Skin securities long or short and has no financial relationship with Zachary Prensky.

Disclosure - Zachary Prensky

At the time of the publication of this report, Zachary Prensky and/or affiliates hold short positions in Nu Skin common stock. More of Mr. Prensky's research can be found at the website of his firm, Little Bear Investments LLC.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.