- Overstock.com (NASDAQ: OSTK) shares have soared in recent weeks, much of that due to hype concerning its t0 (tZERO) venture by CEO Patrick Byrne, and publicity generated by his chief advocate, former money manager Marc Cohodes, who has abruptly (and with scant explanation) reversed his formerly critical stance.

- The hype-driven increase in the share price has overshadowed a longstanding negative factor in evaluating the company: the behavior, character and credibility of the CEO, who has a longstanding practice of accounting games, harassing critics and making untrue statements.

- As he promotes his Overstock position, Cohodes has adopted some of Byrne’s most aggressive tactics. He has sought to intimidate and silence critics in private communications, and has waged an aggressive public campaign harassing skeptics on social media.

- Without critical scrutiny by independent analysts and the financial press, investors are ill-served and the market is not sufficiently exposed to contrary points of view.

|

| Marc Cohodes |

Overstock.com CEO Patrick Byrne is good at many things, but not running a public company. The company has cooked the books for years at a time, and as explored by money manager Dave Kranzler in this Seeking Alpha blog, Overstock is a “dumpster fire waiting to happen,” a cash-burning vehicle run by a hype-happy chief executive and floating on a cloud of hot air.

But Byrne is very good at hype and suppressing negative coverage, and we’ve seen much of the former and little of the latter lately. Overstock shares have climbed. Dissenting voices exist only on social media. There is little press coverage of the company that is skeptical or probing, and puff pieces predominate. The CEO’s long-established record of deception and odd behavior has been disregarded, even distorted. One recent CNNMoney article rewrote history by turning Byrne’s infamous “Sith Lord” fantasy into a metaphor, and not the paranoid delusion, referring to an imaginary person, that it actually was.

Reporters and analysts who have covered Overstock in the past know that critical scrutiny exacts a price in the form of personal attacks, sometimes against one’s spouse and family. As has been chronicled over the years by myself and others, Byrne and his employees and surrogates have bullied, threatened and stalked analysts, the press, and even ordinary citizens who speak out against the company and his methods.

Overstock is still benefitting—and the market continues to lose out—from this campaign of intimidation.

Little if any attention is paid to the fact that Byrne’s credibility was shattered by a devastating 2016 libel verdict which excoriated Byrne and found that the truth "was of no consequence” to him and his minions. His Deep Capture smear site, which was the subject of the still-pending libel action, has never been repudiated, and is used from time to time to counteract the sparse negative press coverage. Most recently, as noted in my last blog, Deep Capture was deployed against a Daily Beast reporter, who was accused of going over to the “dark side” when he made queries for this article.

In an increasingly difficult journalism environment, news organs and journalists can be forgiven for not wanting to deal with that kind of harassment.

Byrne has never withdrawn any of his smears against the media, nor disavowed and apologized for the underhanded tactics that he has used against the media and his critics over the years. They included stalking journalists like Barry Rithotz and their families (including their minor children), on Facebook. My understanding is that Byrne very recently privately reaffirmed his pride in his previous behavior, even as he occasionally makes vague and also private expressions of regret to win over critics.

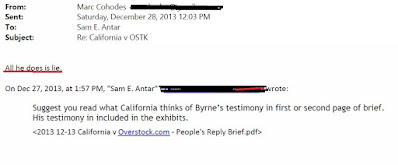

Marc Cohodes, a retired money manager, used to have no illusions about Byrne. His now-defunct hedge fund once was short the stock and was sued by the company. He said in a 2011 deposition that Byrne was “not fit to run a public company,” and in December 2013 he was telling me in an email, after Byrne was sued for consumer fraud in California, that “all he does is lie.” (Click on image to enlarge.)

This was a statement of fact, not opinion. Yet all of a sudden, poof! The liar of December 2013 has become the Boy Scout of 2017. Remember that we are not talking about a high school student who used to fib. This is a grown man, 55 years of age, who was CEO of the same public company then and now.

Cohodes misrepresents concerns about Byrne, which relate to his current integrity and honesty, as the “2005 investment playbook.” He has nothing much to say except that he was “wrong” about Byrne. When queried about Byrne’s past record of nutty behavior, his response is along the lines of “what are you going to believe, me or your own two eyes?”

Cohodes began accumulating the stock in mid-2017 and started hyping it on October 10 at a Grant’s conference. His sudden, dramatic and unexplained “change of mind” about Byrne has paid off in multiple ways. My last Seeking Alpha blog described how his name mysteriously vanished from Deep Capture after he began to accrue shares, hype the company and slobber over Byrne.

Cohodes has not disputed the accuracy of my blog. He has called being mentioned in Deep Capture a “badge of honor.” That is hard to believe, considering that the references to him, though mild compared to the personal attacks directed at journalists targeted by Byrne, must have grated at this very thin-skinned and vain man.

Cohodes now describes Byrne, who he said did nothing but lie four years ago, as a “visionary.” He has never explained—and no member of the media has ever asked him—what happened, other than his acquisition of shares, turned a pathological liar into a “visionary.”

When it comes to the integrity of its CEO and the longtime practice of hounding critics, there isn’t a “new Overstock” or “new Patrick Byrne” any more than there was a “new Nixon” in 1968. Byrne, who has refrained from antics in recent months, now has Cohodes to roll down in the mud for him. He has become the kind of stock promoter that the Cohodes I knew a short while ago, before he loaded up on Overstock shares, would have found disgusting.

On Twitter, Cohodes tries to build a facade of respectability, thumping his chest over press freedom and over-eagerly praising journalists who haven’t crossed him. He spends a lot of time attacking CEOs who have only a fraction of Byrne’s evil track record. But his main passion is not shorting miscreants but shilling for one, and copying his new friend’s time-tested tactics.

In this blog I will describe how Cohodes and his allies have reprised the role that Byrne used to delegate to a small coterie of Internet hoods, led by a self-styled “black ops” hood named Judd Bagley. Bagley founded Deep Capture and engineered the cyberstalking and character assassination methods that made the company a laughingstock and toxic to analysts and the media, attacking critical reporters and boosting those who write superficial puff pieces or kiss his butt. Cohodes loves investigative reporting, except when it costs him money. He recently trashed CNBC, much as Byrne used to do, for not hyping Overstock.

Bagley founded the company’s much-hyped cryptocurrency initiative, but left when his forgery conviction and drug addiction made him too controversial even for Byrne. He is now director of communications at Evernym, Inc. in Utah.

While there is no new Overstock, but there is a new Bagley.

‘Lay off Byrne….. Leave him be, as a favor to me’

I first communicated with Marc Cohodes in late 2007 after I had already turned my life around, and had received favorable publicity by Joe Nocera (NY Times), Floyd Norris (NY Times) Brett Arends (Boston Herald), Herb Greenberg (Wall Street Journal and Market Watch), and many others (Documented here, here, and here) I had already taught about accounting fraud to dozens of law enforcement agencies, companies, professional groups, and universities. His public comments that he somehow fished me out of the gutter are, quite simply, lies.

Since he makes such a fuss about my failing to show him sufficient “loyalty,” I would like to point out that I have never done any compensated work for Cohodes, and he has never referred me to any person for paid work. I met him, stayed on his farm overnight when I taught at Stanford University, had dinner with him a few times, and attended his wedding. I gave him and his hedge fund friends a great deal of free forensic accounting advice and analysis. But I did not feel that either I was beholden to Cohodes or he to me. When I stopped by his house for dinner I did not sign away my conscience or agree to join him in pumping his future stock picks.

In late October, after I posted tweets showing mild concern about Byrne’s track record, I received the first of a series of incessant, manipulative, repetitive, sometimes delusional text messages from Cohodes, in which he portrayed himself as my long-lost savior and myself as an ungrateful child. (Full disclosure: I am a few years older than him.)

Tuesday, October 24, 2017, 1:34 PM Eastern Time

Marc Cohodes: Lay off Byrne… what are you trying to accomplish?

Sam Antar: Byrne has had plenty of time to make amends. He is exploiting you. To me, he’s defective merchandise. He hasn’t changed. He’s just bad product in a new box.

Marc Cohodes: Leave him be, as a favor to me…

He wore me down and I consented. But his demand for silence just to line his pockets grated at me. He had no right, none whatsoever, to shut me up. Who did he think he was? It began to get me upset. I had many other friends who I knew a lot better than Cohodes who were slandered by Byrne and felt betrayed by Cohodes. Their feelings were no less important than his, arguably a lot more so. He believed that since he now owned the stock he was more worthy of deference than the many who did not.

Also, I thought that Cohodes was, to be frank, “losing it.” He had copied me on a bullying, guilt-trip email he sent to investigative reporter and author Gary Weiss a week earlier that was just plain creepy. (I describe the email below.) Mutual friends were expressing bewilderment, as well as irritation, about his behavior.

I told Cohodes that I could not in good conscience remain silent on Byrne simply because he, now a large Overstock shareholder, didn’t want me to.

The text messages started coming again. He wouldn’t leave me alone or respect our difference of opinion. He had built up in his mind that I “owed him.” He reminded me of the Jackie Gleason character, “Maish,” in Requiem for a Heavyweight, putting on the phony guilt, trying to force Mountain Rivera (Anthony Quinn) to act against his conscience.

Saturday, November 4, 2017, 2:40 PM Eastern Time

Marc Cohodes: Terribly disappointed in you

Marc Cohodes: Terribly

Marc Cohodes: With all that has gone on you promised me you would stop and you just keep going

Marc Cohodes: That’s a shame

I didn’t respond to his con game. More texts came. I decided to respond.

Monday, November 6, 2017, 4:53 PM

Sam Antar: You are correct that I agreed to your request that I would stop criticizing Overstock and Byrne, but my conscience said otherwise. Byrne did a lot of bad things and has [I meant “hasn’t”] anything to make things right. In any case, take care and goodbye.

Sam Antar: Correction: Byrne hasn’t done anything to make things right.

Marc Cohodes: Really?

Sam Antar: People were hurt by his smears, libel, and innuendo

Marc Cohodes: Noone more than me…

Marc Cohodes: Suit yourself

Sam Antar: True, but this is not only about you. Other people were hurt by the bad things Byrne has done. In any case, all the best.

Marc Cohodes: Who Sam? Who can’t turn the page?

Sam Antar: Byrne could’ve turned the page a long time ago. He hasn’t. It’s up to him to make things right.

Marc Cohodes: Byrne has let it go… up to you Sam, It makes me sad I m (sic) so disposable to you…

Marc Cohodes: You gave me your word..

Sam Antar: Friends correct friends when they are wrong as I’m trying to explain why you are wrong. What you requested, I could not in good conscience carry out. Byrne’s lies are still all over the internet. He can still make things right. He has an earnings call this week. Let’s see what he does or doesn’t do.

The comment that Byrne “has let it go” bothered me. Let what “go”? That he had smeared people? Lied about them? How decent of him to “let it go” that he had behaved like a snake. It reminded me of the time Klaus Barbie was interviewed at his hideout in South America and said of his victims "I've forgotten. If they haven't, it's their concern.”

There was more infantile nagging, more manipulation, more guilt-tripping over imaginary “favors” he had done for me. He wouldn’t let up, but just kept going on and on. He was obsessed with getting me to shut up and join Team Overstock.

A few days later, Cohodes sent me a threat.

Saturday, November 11, 2017 3:39 AM

Marc Cohodes: The way this comes down Sam is that after all of the energy I focused on improving your reputation and business I dont have the heart to rip you apart. Its truly sickening how you behave towards the only person who stood by you when no one would. I will ignore you till you one day make it right again. [emphasis added]

I responded by reminding Cohodes that “I repaired my reputation long before I met you among the people who matter.” But Cohodes wasn’t interested in reality.

Byrne offers to take down Deep Capture—for a little while

On Nov. 17, Cohodes texted me to say, “I have arranged a truce.” I then was contacted by a third party who Marc also was hounding. The so-called “truce” Cohodes/Byrne offered was laughable. Byrne would temporarily, for an unspecified period of time, take down Deep Capture if Gary Weiss and I deleted all of our tweets! Our tweets could not be reinstated but Byrne could and would put Deep Capture back up at the press of a button. For some reason that remains a mystery to me, our tweets were causing major angst on Salt Lake City. But not enough for Byrne to do more than offer a “deal” that was an insult to the intelligence.

I was aware by this point that Cohodes had already gotten himself edited out of Deep Capture. I was also aware that even permanently deleting Deep Capture at this late date would have been an empty gesture.

What is needed is to repair the reputational damage he has caused, not a “truce” or a “deal” but for Byrne to do the right thing: to retract his lies, apologize, and replace his Deep Capture smear site with a big, fat statement of contrition. He needs to retract all the smears that he planted in the media and that still occasionally pop up. He needs to make amends, not manipulate. He needs to keep in mind that even a retraction and apology, years after the slanders he published, would not mean much to a lot of victims of his malice, and that many no doubt would rightly reject his apology.

Byrne has a lot of work to do if he really wants to set things straight, so he had better get going. Which he will do just as soon as pigs fly and hell freezes over. Byrne is the same old con artist and smear peddler that he has ever been.

The personal attacks begin

After this “truce” nonsense was rejected, Cohodes began to turn up the attacks flowing from his increasingly vitriolic, bitter Twitter feed. His attacks became hysterical and personal after I published on Nov. 27 the Seeking Alpha blog, "Marc Cohodes Buys Stock And Vanishes From Overstock CEO's Smear Site.” In that blog I described how Cohodes was carefully edited out of Deep Capture after he began accumulating a stock position that he has described as “not small” and started hyping the company and putting Byrne on a pedestal.

Cohodes responded with two types of personal attacks, which he has repeated monotonously to this day, sometimes using identical wording. He never responded to the substance of my last blog and I expect more of the same for this one.

First, he criticized me for not owning or shorting the stock. His opinion is that only people with conflicts of interest, people "talking their book,” are worth a damn. That is the exact opposite of how things are in the real world, as opposed to whatever imaginary life Cohodes occupies at his chicken farm.

I hope that the reporters who suck up to Cohodes, or that he sucks up to, remember that the next time he tries to pitch them on something. To Cohodes their opinion is worthless, unless they agree with him. They’re “bleacher bums” who don’t have “skin in the game.”

He also has whined endlessly that because I had dinner at his place, and once held a chicken in front of the camera, I had committed a grave personal betrayal. As noted, that was due to a personal history that existed only in his mind.

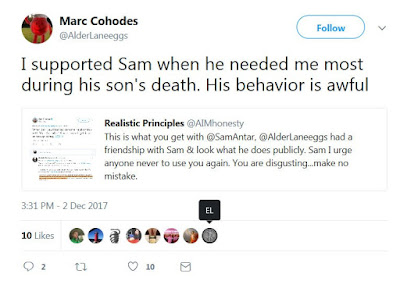

Cohodes became more and more out of control on his Twitter feed, calling me a "Pathetic individual and a sociopath." He even had the bad taste to invoke my son, who passed away a few years ago, saying that he “supported Sam when he needed it the most during his son’s death.” That makes it seem as if he was sitting with me, an arm around my shoulder, comforting me in my grief.

That would have been awfully sweet of Cohodes if he had done that. But he didn’t. It just happened in his fertile imagination. He sent me a very nice, very brief email, as did hundreds of other people who are not asking me to pump their portfolios. People who actually did visit me and who were there for me think that Cohodes is off his rocker and despise Overstock. None of them has ever tried to manipulate or guilt-trip me over that or anything.

For him to even mention my son in an effort to make money on stock was cheap, unethical and infuriating. My family was deeply offended, and I think that Cohodes was intentionally trying to not only promote his miserable stock holdings by that tactic but also cause pain to me and my family. Not even Patrick Byrne stooped to such disgusting tactics.

His followers are so blinded by their money lust that quite a few of them actually “liked” that tweet (see screenshot below). Among them was Evan Lorenz, Deputy Editor of Grant’s Interest Rate Observer, where Cohodes made his Overstock pitch. Lorenz is “EL” in the screenshot. Lorenz is an active defender of Cohodes on Twitter, which doesn’t strike me as appropriate behavior for an editor of a respectable newsletter. (Click on image to enlarge.)

I wasn’t the only Overstock skeptic Cohodes has tried to bully and intimidate behind the scenes. His tactics have made people who knew him before Overstock concerned about the man.

One silencing effort that I became personally aware of, because he directly involved me, was an effort by Cohodes to bully investigative journalist Gary Weiss, a longtime critic of Overstock. It came after an exchange of tweets in October, initiated by Cohodes, on his embrace of Byrne. It was a perfectly civil difference of opinion, but it was unbearable to Cohodes.

Cohodes copied me and two journalists, Roddy Boyd and Bill Alpert, on a bizarre, bullying, creepy email that he sent Gary on Oct. 15, chiding him for the “shit” he was giving him.

By copying the three of us on his tantrum, Cohodes put myself, Roddy and Bill in an uncomfortable position, but particularly the two reporters. Cohodes is a major contributor to Roddy’s Southern Investigative Reporting Foundation (SIRF), one of the largest if not the largest donor in 2017. He should respect Roddy’s independence and not get him involved in anything having to do with his private squabbles or his portfolio interests. Bill had just written a brief article describing how Cohodes was now bullish on Overstock, and Cohodes showed little class in trying to get him involved.

Apparently, he felt that I and these two fine journalists would act as his tools and bring Gary to heel. But that didn’t happen and his crude intimidation effort was a flop. I’ve not posted the email and Gary’s response out of respect for the three journalists involved, but will do so if Cohodes lies about it.

Cohodes’s email used the same phony guilt-trip tactics that he later used on me. He made it seem as if Gary didn’t use his keyboard without calling Cohodes for his help and advice. Gary tells me that was a crock, that he has never met Cohodes and spoken to him only twice in his life, once five years ago and the other time in mid-2017 (the latter occasion being a complete waste of time). He was stunned that a person he barely knew would attempt to manufacture a relationship out of thin air to pressure him to act as he wanted on a stock promotion. It was, he said, some of the strangest behavior he has encountered in his many years of writing about the markets.

Cohodes doubles down on the smears

In recent weeks Cohodes has ratcheted up his embrace of Patrick Byrne’s smear tactics.

Some background: I first became interested in Overstock because Byrne used a technique that was unavailable to me when I was running the stock fraud at Crazy Eddie in the 1980s. Beginning around 2005, he deployed on his behalf a coterie of anonymous Internet trolls who swallowed his “naked short selling” conspiracy theory, and stalked and attacked critics of Overstock and other stocks that were being hyped at the time. Among their targets were members of the press, analysts and short-sellers.

At the time, women and Jewish journalists were subjected to misogyny and anti-Semitism by trolls on the Internet, mostly but not entirely anonymous. There were outright attacks on Jews by the likes of former Stratton Oakmont cold-caller Darren Saunders, and innuendo from Byrne. In 2005, blogger/money manager Jeffrey Matthews exposed what he recently described as “Byrne’s creepy, Bannon-like, anti-Semitic comments” in blog posts which can be found here and here. It should be noted that Matthews now is bullish on Overstock.

The widely followed blog The Stalwart observed at the time, referring to a Byrne missive discussed by Matthews, that “it's not a stretch to read an anti-Semitic tone into the letter.”

In his recent tweet, Matthews said that he hoped Byrne had “disowned” his comments. He hasn’t. He stands by everything he has said—including his anti-Semitic dog whistles.

As Byrne did back then, Cohodes uses a handful of Internet trolls as proxies. He retweets and likes their tweets and sometimes he is even photographed with them, so as to reward them for their “loyalty” by building up their following. But Cohodes has done worse than promote anonymous internet trolls.

Cohodes disseminates the thoughts of Ed Manfredonia

The most interesting Cohodes ally to emerge on Twitter in recent weeks is a resident of Queens named Edward Manfredonia.

I’ll let Manfredonia speak for himself. Here is a sampling of the literally thousands of posts and tweets that he has put out over the Internet. I’ve removed most names to not repeat the defamation:

Robert Morgenthau, New York County District Attorney, and [redacted] made certain that [the latter’s husband] could molest women. [Note: this is the most recent post on his blog, and has been on its front page for weeks.]

[redacted] publisher of [redacted], still sucking blood out of Medgar Evers College [headline]

[redacted--wife of publisher] has engaged in immigration fraud

In 2009 [redacted] entered into a sham marriage with [redacted], Publisher of [redacted] . . [redacted] refused to give in. [redacted] demanded her orifices.

Judge [redacted], an Orthodox Jew, permitted this perjury because [redacted] is Jewish and I am a Catholic.Thus, [the judge] believes that I am not quite a human being because I am not Jewish.

I stated that [a judge]’s many lies were due to the fact that [the judge] and [redacted] were Jewish

Robert “Tzaddick’ Morgenthau, who according to Sydney Schanberg does not indict his friends

[redacted] has willfully and intentionally lied to protect Russian killers of Americans because these killers were Jews.

[redacted] laundered money via a Jewish billionaire,

The [redacted---prominent publishers] covered up rape, money laundering and narcotics smuggling because [redacted], former chairman of the Amex and [redacted] wanted it covered up

[redacted] permitted 1,400 Americans, including children and pregnant women, to be murdered because he smeared my name.

Like [redacted,] [redacted, a prominent editor] regards Italian-Americans to be subhuman and will even falsely attribute two murders to the Italian Mafia to cover up the crimes of Russian Jews

He is known to anyone who has followed Overstock for any period of time. And if you haven’t, a glance at his Twitter feed speaks for itself. (No, I’m not going to link to that pile of dung.)

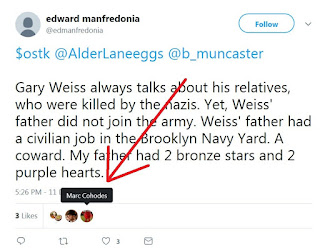

Cohodes began his rendezvous with Manfredonia by liking and retweeting a vicious personal attack on Gary Weiss on Nov. 11. (Click on image to enlarge.)

Cohodes later took down his retweet of that garbage, after, I understand, he was warned to do so by a colleague.

A few weeks later Cohodes was back to promoting Manfredonia with a vengeance, starting with this (click on image to enlarge):

A couple of days later he retweeted a lurid Manfredonia fabrication about Gary Weiss. Then he really hit bottom.

Aping his pal Byrne, a nutcase who has had no compunction about attacking the families of his critics, Cohodes “liked” a cowardly, disgusting attack not on Weiss but on Weiss’s long-deceased father, comparing this career U.S. Navy employee unfavorably with his own dad, whom he claimed was a war hero. (Click on image to enlarge.)

Cohodes also liked two other Manfredonia tweets attacking Gary’s wife. The fact that Cohodes would retweet Manfredonia’s filth and approve of his vile attacks on family members shows the depths to which he has sunk, and how he has adopted Patrick Byrne’s gutter morality.

Roddy Boyd, himself a victim of slurs and smears from Byrne and many other fraudsters that he has exposed, expressed outrage. (Click on image to enlarge.)

He had this to say about Manfredonia after the latter began to infect his Twitter feed (click on image to enlarge):

Cohodes cannot plead ignorance about Ed Manfredonia. Ed has been an outspoken Byrne fan since Deep Capture, which quoted and supported him, and a quick glance at his Twitter feed and blog would have made it clear to Cohodes the character of the person whose “work” he was disseminating.

At this point I have to interject that Manfredonia insists, over and over again, that he is not anti-Semitic. He repeatedly cites a 2007 letter that he solicited from the ADL. The letter is the lead illustration on his Twitter page. He says that the letter exonerates him from charges of anti-Semitism. Patrick Byrne and his henchman Judd Bagley agree. In a Deep Capture post on Feb. 9, 2008, Byrne enthusiastically endorsed Manfredonia and, citing that same ADL letter, insisted that he was not anti-Semitic. His henchman Bagley called him a “good and principled man.”

In fact, Byrne lied about the contents of the ADL missive.

The letter, still hosted on a Bagley website, simply says that the group was not getting involved in the dispute that Manfredonia brought to their attention (The ADL gets involved in major issues, not disputes between private parties). After Manfredonia resurfaced as a Cohodes ally, the former ADL lawyer who wrote that letter, Yael Mazar, confirmed to Gary Weiss via email: “The letter I wrote on behalf of ADL does not make any determination at all. It simply says that ADL cannot be involved nor make a determination.”

Byrne has never repudiated his lie about the ADL letter, his enthusiastic embrace of Manfredonia or the anti-Semitic innuendo that Jeffrey Matthews highlighted.

I don’t believe that Cohodes is anti-Semitic. What I do know is that he has lost all sense of proportion on Overstock.com, and is completely reckless and unscrupulous. He will stop at nothing to hype the hell out of that stock and to attack people who get in his way.

I’m sure that Cohodes will respond to the above by saying that all of the above are irrelevant to the new, vibrant, changed Overstock and its “visionary” CEO. So why has he made Manfredonia relevant? Why has Cohodes retweeted him and liked his tweets? Why have his proxies and surrogates endorsed and encouraged Manfredonia?

If Byrne’s smear campaign is a thing of the past, why has Cohodes kept it going? How can Cohodes go on and on about how Overstock has changed when he has made sure that it has not, that it is still a company you daren’t criticize?

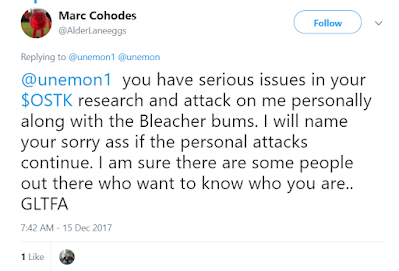

Cohodes threatens to dox a critic

As you can see from this Dec. 11 tweet (below), Cohodes does not distinguish between bona fide market observers, such as Jeffrey Matthews, and anonymous trolls. Note also that in this tweet Cohodes boasts that he got these people into the stock early on, before his big pump in October. (Click on image to enlarge.)

Cohodes endorses and enables trolls who hide behind anonymous handles while attacking Overstock critics. Anonymity is OK with Cohodes—except when that anonymous person is critical of Overstock. Cohodes has posted obsessively, sometimes multiple times a day, to intimidate and hector the Overstock critic “unemon1,” who has posted skeptical views concerning the company’s blockchain venture.

As I pointed out in my last blog, doxing threats were frequently used by Bagley even before he founded the Deep Capture site.

Cohodes is getting more and more out-of-control in his tweets. A couple of weeks ago he tweeted this violent fantasy (click on image to enlarge):

Cohodes is getting more and more out-of-control in his tweets. A couple of weeks ago he tweeted this violent fantasy (click on image to enlarge):

Cohodes recycles the same angry invective over and over. Here’s a typical one from yesterday. (Click on image to enlarge.)

What is this childish name-calling supposed to be, an attack on my credibility? It isn’t. It’s an attack on Cohodes’s credibility, and a convincing one.

It’s sad to see a person who used to challenge bullies become a bully himself, in the service of an even bigger bully.

That line from Pogo comes to mind: “We have met the enemy, and he is us.”

Conclusion: The Media Needs to Wake Up

In his Overstock pump, Marc Cohodes has justified everything he has said and done on the basis of the stock market performance of this ridiculously hyped company. It is as if to him there is no such thing as right or wrong, just how well he and Byrne pump the stock. If the stock goes up, everything he says is right. If it goes down, everything he says is wrong.

I would suggest that a portfolio is no substitute for a conscience.

Cohodes frequently falsely suggests to his peanut gallery on Twitter that my criticism of his lionizing of Patrick Byrne, and my concerns about the CEO's integrity, are the same as a recommendation to sell or short the stock. Investors need to make up their own minds based on the facts. I am not an investor, long or short.

I’ve been out of the stock market for almost ten years, and I have never recommended a buy or a sell, much less a short sale, of this or any stock. I certainly would not recommend a buy or sell of a stock that is being openly manipulated like this one, a subject of irrational hype, in which critics are subjected to personal attacks, and in which the media is too co-opted, indifferent or intimidated to engage in skeptical reporting.

In reading various Twitter discussions among journalists about Overstock, it is striking how reporters I deeply respect keep rationalizing why they do not write critically about the CEO some of them found to be so intriguing in 2007. I think some soul-searching is in order.

Cohodes has been spared the scrutiny that he deserves. The profiles of him that have appeared recently have been one-sided and superficial. Whether this is due to laziness or his cultivation of the press is hard to say.

Cohodes has built a reputation on his stock picks, and his word, amplified by the financial press, has driven up the price of the stock. But he has no verifiable recent track record.

We know that the last time he ran money for other people was when he was manager of a fund called Copper River. It collapsed in 2008. It was the only short fund to meet such a fate in what was otherwise a great year for short-sellers. He blames Goldman Sachs, but I wonder if Cohodes wasn’t at least equally to blame. No one forced him to keep his assets at Lehman Brothers even after it was plain that the company might be the next to go belly-up.

Here’s hoping that someday soon the media will wake up and give this company and stock promoter the skeptical attention they warrant.

It won’t be pleasant. Manfredonia has begun to include Roddy Boyd in his attacks. Some of them may get slime thrown at them and their families, perhaps even parents and spouses as Gary was. But the public deserves no less.

Written by,

Sam Antar

Recommended Reading:

Inside the Always Nasty, Frequently Sexist, and Often Litigious World of Financial Twitter, by Michelle Celarier, Institutional Investor, August 1, 2018

5,000 Reasons Why the Overstock.com Saga is Crazier Than Ever, by Gary Weiss Blog, January 30, 2018

Stock Promoter Marc Cohodes Issues a Death Threat, by Sam Antar, YouTube, November 18, 2018

Disclosure:

I am a convicted felon and a former CPA. As the CFO of Crazy Eddie, I helped mastermind one of the largest securities frauds uncovered during the 1980's. Today, I advise law enforcement agencies and professionals about white-collar crime and train them to catch the crooks. I perform forensic accounting services for law firms and other clients.

I have no investment position in Overstock.com shares, long or short.

It’s sad to see a person who used to challenge bullies become a bully himself, in the service of an even bigger bully.

That line from Pogo comes to mind: “We have met the enemy, and he is us.”

Conclusion: The Media Needs to Wake Up

In his Overstock pump, Marc Cohodes has justified everything he has said and done on the basis of the stock market performance of this ridiculously hyped company. It is as if to him there is no such thing as right or wrong, just how well he and Byrne pump the stock. If the stock goes up, everything he says is right. If it goes down, everything he says is wrong.

I would suggest that a portfolio is no substitute for a conscience.

Cohodes frequently falsely suggests to his peanut gallery on Twitter that my criticism of his lionizing of Patrick Byrne, and my concerns about the CEO's integrity, are the same as a recommendation to sell or short the stock. Investors need to make up their own minds based on the facts. I am not an investor, long or short.

I’ve been out of the stock market for almost ten years, and I have never recommended a buy or a sell, much less a short sale, of this or any stock. I certainly would not recommend a buy or sell of a stock that is being openly manipulated like this one, a subject of irrational hype, in which critics are subjected to personal attacks, and in which the media is too co-opted, indifferent or intimidated to engage in skeptical reporting.

In reading various Twitter discussions among journalists about Overstock, it is striking how reporters I deeply respect keep rationalizing why they do not write critically about the CEO some of them found to be so intriguing in 2007. I think some soul-searching is in order.

Cohodes has been spared the scrutiny that he deserves. The profiles of him that have appeared recently have been one-sided and superficial. Whether this is due to laziness or his cultivation of the press is hard to say.

Cohodes has built a reputation on his stock picks, and his word, amplified by the financial press, has driven up the price of the stock. But he has no verifiable recent track record.

We know that the last time he ran money for other people was when he was manager of a fund called Copper River. It collapsed in 2008. It was the only short fund to meet such a fate in what was otherwise a great year for short-sellers. He blames Goldman Sachs, but I wonder if Cohodes wasn’t at least equally to blame. No one forced him to keep his assets at Lehman Brothers even after it was plain that the company might be the next to go belly-up.

Here’s hoping that someday soon the media will wake up and give this company and stock promoter the skeptical attention they warrant.

It won’t be pleasant. Manfredonia has begun to include Roddy Boyd in his attacks. Some of them may get slime thrown at them and their families, perhaps even parents and spouses as Gary was. But the public deserves no less.

Written by,

Sam Antar

Recommended Reading:

Inside the Always Nasty, Frequently Sexist, and Often Litigious World of Financial Twitter, by Michelle Celarier, Institutional Investor, August 1, 2018

5,000 Reasons Why the Overstock.com Saga is Crazier Than Ever, by Gary Weiss Blog, January 30, 2018

Stock Promoter Marc Cohodes Issues a Death Threat, by Sam Antar, YouTube, November 18, 2018

Disclosure:

I am a convicted felon and a former CPA. As the CFO of Crazy Eddie, I helped mastermind one of the largest securities frauds uncovered during the 1980's. Today, I advise law enforcement agencies and professionals about white-collar crime and train them to catch the crooks. I perform forensic accounting services for law firms and other clients.

I have no investment position in Overstock.com shares, long or short.